The call center industry has some of the highest employee turnover rates; on the average ranging from 30% – 45% but in some centers over 100 percent.

One in five employees miss work to deal with a financial problem and 71% of employees identify money as a source of stress. A new HR benefit from fin-tech company PayActiv allows employees to access their earned yet unpaid wages and in turn helps reduce employee financial stress, decrease turnover, and further engage employees.

Employee stress directly impacts businesses: According to Mercer’s Inside Employees Minds Survey, companies lose over $250 billion annually. About 5 percent of the total annual payroll. On a per employee basis this is an aggregate of 20 hours lost per month worrying about financial issues. Even at minimum wage this amounts to $200 every month.

Call centers are getting smarter about engaging opt-in customers and finessing the outbound selling of products and services to build brand loyalty. But what are call center companies doing to build loyalty and reduce attrition within their own workforce?

How and why PayActiv works

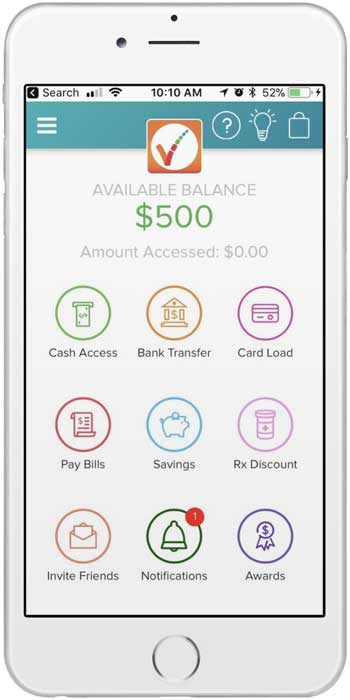

Available at no cost for companies to implement or administer, the PayActiv financial wellness platform gives low-to-moderate income workers access to their earned but unpaid wages between pay periods. The platform also includes tools to help workers budget, save, pay bills, receive financial counseling, and get various useful discounts – all from an app on their smartphone. Businesses that offer PayActiv report reduced rates of absenteeism and turnover, increased productivity and reliability when their workers are more financially secure. Businesses that have adopted PayActiv include Walmart.

PayActiv was founded to improve the lives of individuals living paycheck to paycheck and empower them with the tools needed to achieve financial resilience. PayActiv fronts the cash for all transactions, and all workers, banked and unbanked are eligible. Employees pay a nominal flat fee per pay period, not per transaction. The ability to access wages in a timely fashion helps workers avoid predatory, clickbait debt products.

Mitigating Persistent Business Issues

While no workplace is immune to turnover, employees who are living paycheck to paycheck, earning near minimum wage, experience debilitating financial stress and often need to access wages more frequently than their established pay period.

Short term borrowing between paychecks is now a fixture in the lives of Americans living without savings. Financially underserved consumers spend over $138 billion in fees and interest on alternative financial services to meet between-paycheck finances. Financially stressed individuals spend ~$1,500 per year in payday loans, subprime auto and title loans, along with late bill, overdraft and monthly bank fees.

Stressed employees are distracted employees, and distracted employees cannot fully engage customers. Keeping apprentice call center reps engaged is an essential part of business success and customer engagement. The longer employees are retained, the higher level of performance they provide. Long employee tenure creates high workplace morale, which provides a myriad of benefits such as increased productivity, improved workplace culture, and happier and healthier employees.

About the Author

Sabina Bhatia is Vice President of Strategic Alliances at PayActiv, innovator of financial solutions giving hourly workers timely access to their earned yet unpaid wages. She is an advocate of empowering workers with tools to maximize their wages for greater financial wellness.

Sabina Bhatia is Vice President of Strategic Alliances at PayActiv, innovator of financial solutions giving hourly workers timely access to their earned yet unpaid wages. She is an advocate of empowering workers with tools to maximize their wages for greater financial wellness.

Sabina spent 15 years on Wall Street, and today PayActiv has given her the avenue to make a positive impact in the lives of all working people irrespective of their age, gender or income level.

PayActiv is backed by SoftBank Capital and has won best-in-class awards in both FinTech and HR Technology categories.